Roth ira calculator 2021

This places you in the 22 tax bracket. Roth IRA Conversion Calculator.

Roth Ira Calculator How Much Could My Roth Ira Be Worth

The amount you will contribute to your Roth IRA each year.

. Your IRA could decrease 2138 with a Roth. This limit applies across all IRA accounts. This calculator assumes that you make your contribution at the beginning of each year.

9 rows Amount of Roth IRA Contributions That You Can Make For 2021 This table shows whether your contribution to a Roth IRA is affected by the amount of your. New Look At Your Financial Strategy. This calculator assumes that you make your contribution at the beginning of each year.

Ad TIAA IRAs Can Give You The Flexibility And Convenience You May Need. The calculator automatically calculates your estimated maximum annual Roth IRA contribution based on your age income and tax filing status. This calculator assumes that you make your contribution at the beginning of each year.

One of the most important factors in the decision is what. Traditional IRA calculator Choosing between a Roth vs. Choose the appropriate calculator below to compare saving in a 401 k account vs.

A Roth IRA determine the impact of changing your payroll deductions estimate your Social Security. If you already have a Traditional IRA you may be considering whether to convert it to a Roth IRA. Ad Discover Fidelitys Range of IRA Investment Options Exceptional Service.

New Look At Your Financial Strategy. It is important to. Call 866-855-5635 or open a Schwab IRA today.

For 2022 the maximum annual IRA. Roll Over Into A TIAA Roth IRA Get A Clearer View of Your Financial Picture. I would also suggest you use the Roth IRA Calculator above to help you decide how much you are eligible to contribute.

Technically the minimum contribution limit is 1 if. Assume your taxable income is 50000 for 2020. The amount you will contribute to your Roth IRA each year.

For 2022 the maximum annual IRA contribution of 6000 is an unchanged from 2021. It is important to. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments.

Ad Explore Schwabs Infographic To Understand IRA Differences And Contribution Limits. The Roth IRA Conversion Calculator is intended to serve as an educational tool and should not be the primary basis of your investment financial or tax planning decisions. Ad An Edward Jones Financial Advisor Can Partner Through Lifes Moments.

The actual rate of return is largely dependent on the types of investments you select. Visit The Official Edward Jones Site. The Roth IRA has a contribution limit which is 6000 in both 2021 and 2022or 7000 if you are 50 or older.

For 2021 the maximum annual IRA. This convert IRA to Roth calculator estimates the change in total net worth at retirement if you convert a traditional IRA into a Roth IRA. Ad An Edward Jones Financial Advisor Can Partner Through Lifes Moments.

If you were to contribute more than 34200 your tax rate will go up to 24. Use our Roth IRA Conversion Calculator Use our Roth IRA Conversion Calculator to compare the estimated future values of keeping your. Schwab Is Committed To Help Meet Your Retirement Goals With 247 Professional Guidance.

Roth IRA Calculator Roth IRA Calculator Calculate your earnings and more Contributing to a traditional IRA can create a current tax deduction plus it provides for tax-deferred growth. Ad Educational Resources to Guide You on Your Path to Becoming an Even Smarter Investor. Traditional IRA depends on your income level and financial goals.

It is important to. The Standard Poors 500 SP. Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators.

Traditional IRA Calculator can help you decide. For 2022 the maximum annual IRA contribution of 6000 is an unchanged from 2021. For comparison purposes Roth IRA.

IRA Calculator The IRA calculator can be used to evaluate and compare Traditional IRAs SEP IRAs SIMPLE IRAs Roth IRAs and regular taxable savings. Ad We Reviewed the 10 Best Gold IRA Companies For You to Protect Yourself From Inflation. Visit The Official Edward Jones Site.

This calculator assumes that you make your contribution at the beginning of each year. This calculator assumes that you make your contribution at the beginning of each year. This calculator assumes that your return is compounded annually.

For 2022 the maximum annual IRA contribution of 6000 is an unchanged from 2021. You can adjust that contribution. More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge.

Backdoor Roth Ira 2021 A Step By Step Guide With Vanguard Physician On Fire Roth Ira Vanguard Roth

Roth Ira For Kids Make Your Grandchildren Millionaires Retireguide

Free Roth Ira Calculator Retirement Savings Calculator Tbcu

Roth Ira Calculator 2022 Thrivent

Contributing To Your Ira Start Early Know Your Limits Fidelity

Roth Ira Calculator Excel Template For Free

How A Taxable Brokerage Account Can Be As Good Or Better Than A Roth Ira Physician On Fire Video Video Money Management Activities Roth Ira Ira

What Is The Best Roth Ira Calculator District Capital Management

A Roth Ira Conversion Is Probably A Waste Of Time And Money For Most

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Roth Ira Calculator Advantage One Credit Union Mi

What Is A Roth Ira And Do You Really Need One Adopting A Lifestyle Roth Ira Investing Investing Money Roth Ira

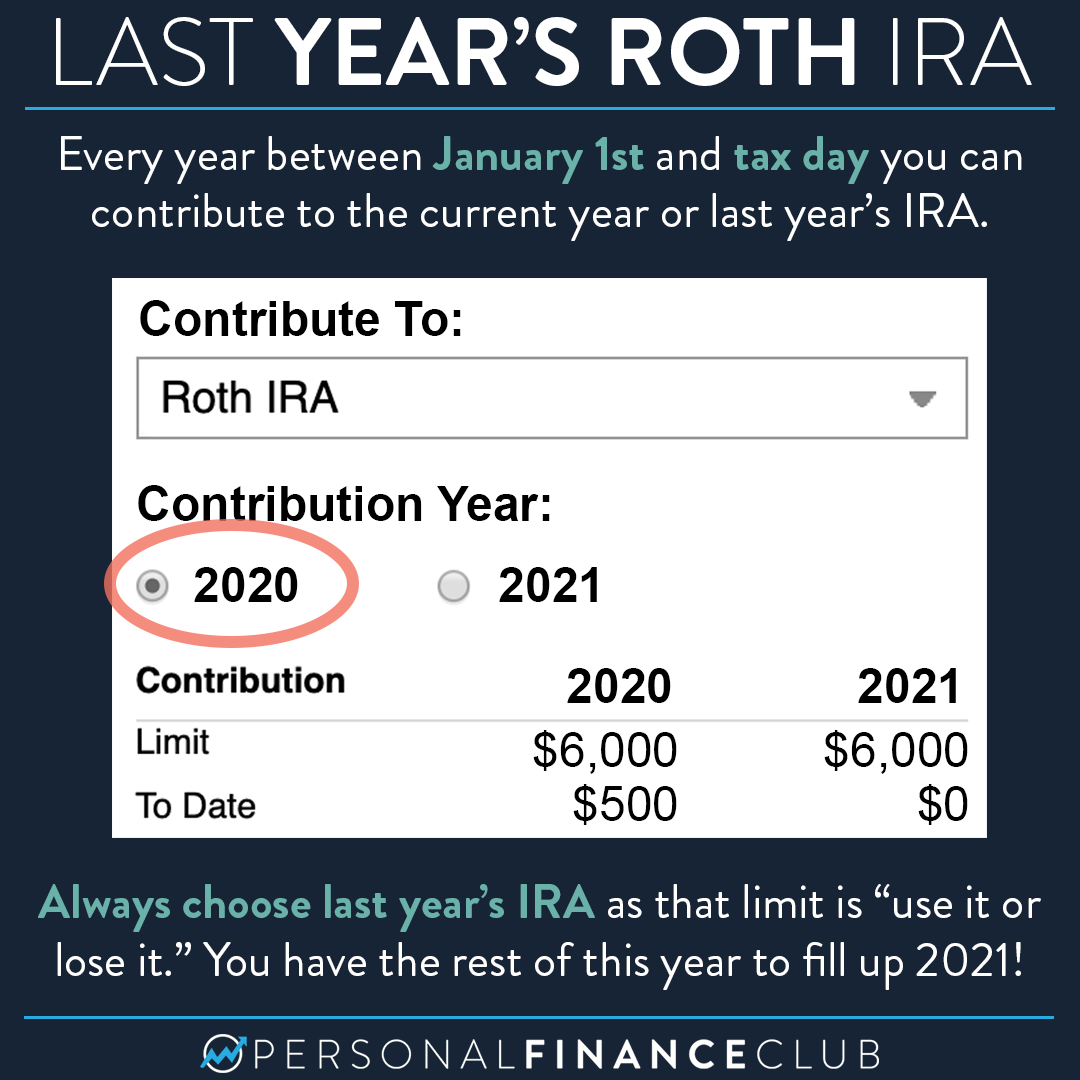

Can I Still Contribute To My 2020 Roth Ira Personal Finance Club

Download Roth Ira Calculator Excel Template Exceldatapro

Historical Roth Ira Contribution Limits Since The Beginning

Roth Ira Conversions Are Surging Here S Why This Retirement Savings Strategy Is So Popular Right Now Roth Ira Conversion Roth Ira Savings Strategy

What Is The Best Roth Ira Calculator District Capital Management